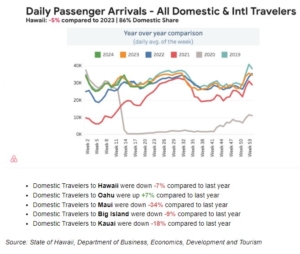

A topic we’ve covered a few times before on our blog is the state of the rental market economy both in Hawai’i broadly, and on our little island of Kaua’i more specifically. Not only is it important for measuring our own successes at navigating the ever-changing tourism industry, but it also helps us provide helpful information to our owners and guests alike. In our July Blog Post (hyperlinked to July), we provided our thoughts on the downward-trending state of affairs for the summer travel season, and this month we’ll be discussing how property owners can hope to maintain a profitable baseline, and how savvy travelers can use this opportunity to find more affordable accommodations for their vacation.

The Dreaded Shoulder Season and How to Prepare

As October fully wraps up, we’re moving into the home stretch of the sluggish shoulder season before winter travel picks up where summer left off. The shoulder seasons (September to November and March to May) are historically slow, but post-COVID have behaved much more profitably than in the past. Over the past few years, shoulder seasons have typically been seen as slightly-lower-earning high seasons, whereas before they were seen as slightly-higher-earning dead zones. Unfortunately, things are slowly shifting back toward the pre-COVID trends, where the shoulders can be lethally slow.

I’m an Owner! How Can I Keep Rental Income Flowing as the Market Dips?

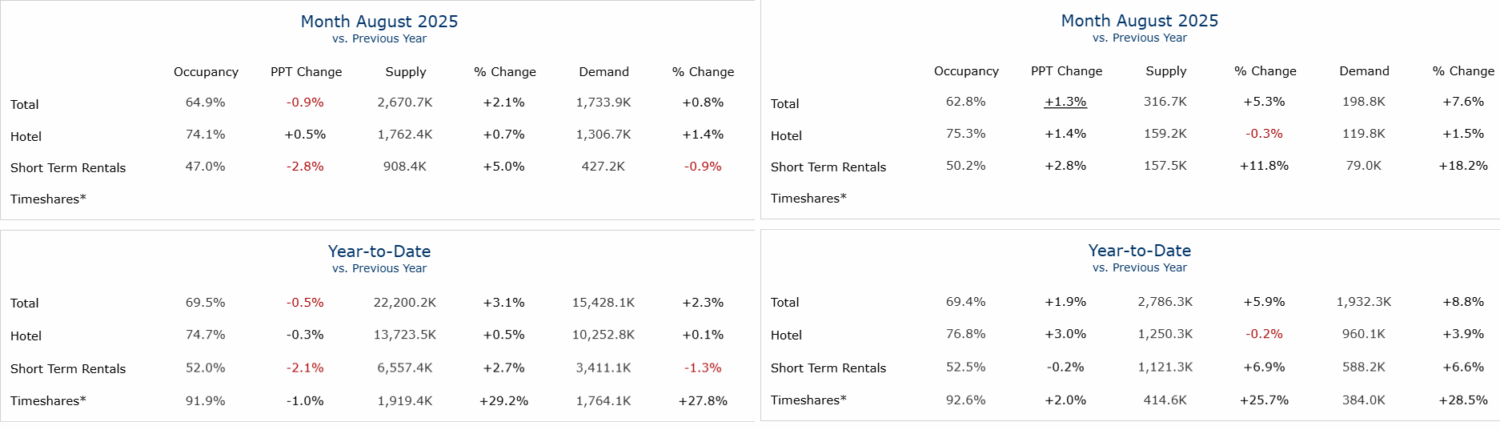

Of course, as a major international destination as well, Hawai’i’s tourism market generally out-performs the mainland travel destination markets, and Kaua’i performs differently still from the rest of the islands. The fact remains, though, that visitor rates are down, even as the supply of rental units increases.

State of Hawai’i (LEFT) vs Kaua’i (RIGHT) monthly and year to date occupancy, supply, and demand statistics. Source: Hawai’i Tourism Authority (hawaiitourismauthority.org)

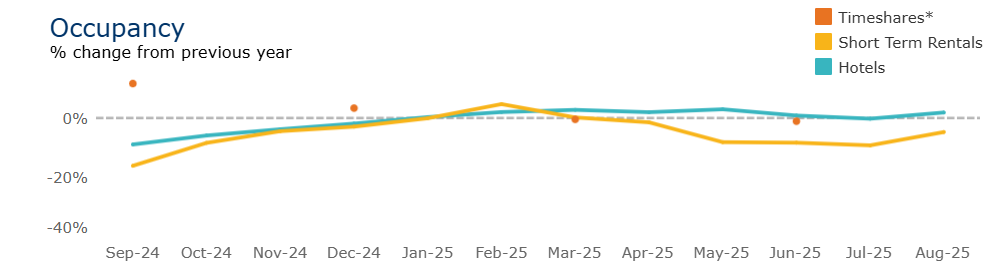

Sep 2024-Aug 2025 changes in occupancy rates between Short Term Rentals and Hotels

Source: Hawai’i Tourism Authority (hawaiitourismauthority.org)

And you don’t need to be an economist to figure that more supply than demand is bad for business. So, while the future of the market is never certain, the smart approach would be to treat these downward trends as the new normal, and try to price your units accordingly. If business is slow, keeping rates down to remain competitive is a much stronger strategy than hoping for a sudden uptick in visitor activity. Middle-income vacation rental properties are the most competitive rental market, therefore they need to be the most responsive to guest spending habits. Luxury rentals and extreme budget rentals both cater to specific audiences, and are therefore able to take a much less reactive approach. And while it can be daunting to suddenly have to drop prices, or suddenly increase them in a strong season, it also gives us the advantage of being able to realistically meet guests at their spending level, while still providing a great vacation rental experience.

I’m A Guest! How Can I Use this Opportunity to Find Affordable Accommodations?

Although shoulder seasons are famously slow in seasonal destinations, they’re also famously full of good deals. And as the middle-income rental market continues to have its struggles, those deals can be found year-round in many cases. One important thing to understand in the short-term rental market, is that the updatedness of the property varies largely. This is especially true of the units on Kaua’i, where the location is isolated, new construction is slow to be completed, buildings are old, and supplies take weeks, or even months, to ship from the mainland. If you want to stay in a completely remodeled condo with air-conditioning, you’re going to be seeing prices that are consistently higher, sometimes even higher than the luxury hotels on the island. If you don’t mind, however, staying in a condo with a kitchen from the ‘70s, or an out of date bathroom, then you’ll be able to find great deals on rentals, especially if you’re looking last minute. Oftentimes the older units are half the price of the remodeled ones, and on an island where visitation costs are already high, saving $300 makes a world of difference.

Looking Forward to the Future

As we said before, it’s impossible to know if this ongoing downward trend in visitor activity is the new normal, or just a momentary trend, but either way we want our owners and our guests both to have an optimal experience. We’ll continue to provide the same great vacation rental experience for all our guests, while honestly and professionally guiding our owners through the ups and downs of a market that changes every quarter, every year.